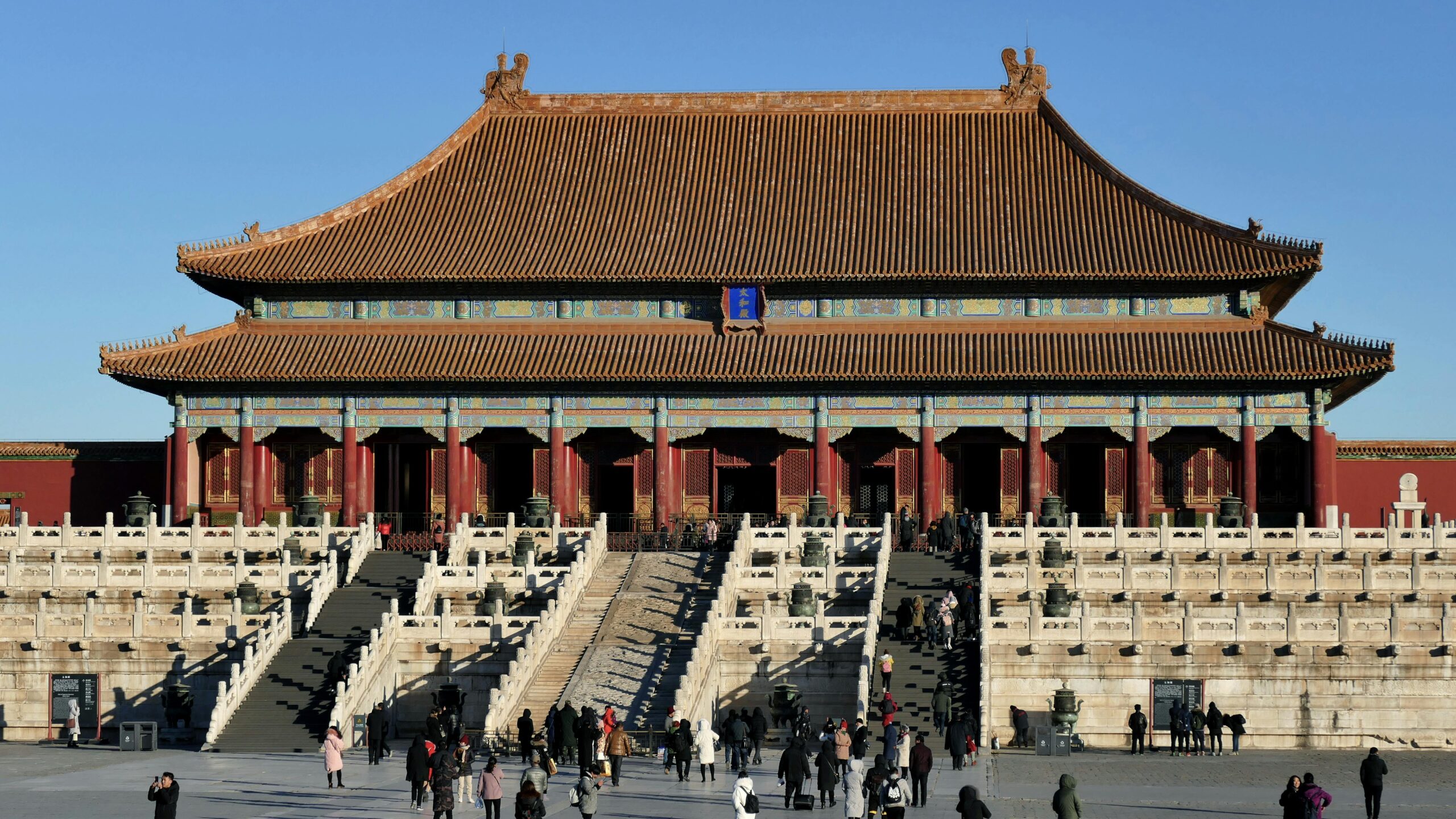

This paper is one of the first to offer a comprehensive analysis of the impact of green finance-related policies in China, utilizing text analysis and panel data from 290 cities between 2011 and 2018. Employing the Semi-parametric Difference-in-Differences (SDID) we show that overall China’s green finance-related policies have led to a significant reduction in industrial gas emissions in the review period. Additionally, we found that Fintech development contributes to the depletion of sulfur dioxide emissions and has a positive impact on environmental protection investment initiatives. China is poised to be a global leader in green finance policy implementation and regulators need to accelerate the formulation of green finance products and enhance the capacity of financial institutions to offer green credit. While minimizing the systemic risk fintech poses, policymakers should encourage fintech to actively participate in environmental protection initiatives that promote green consumption.