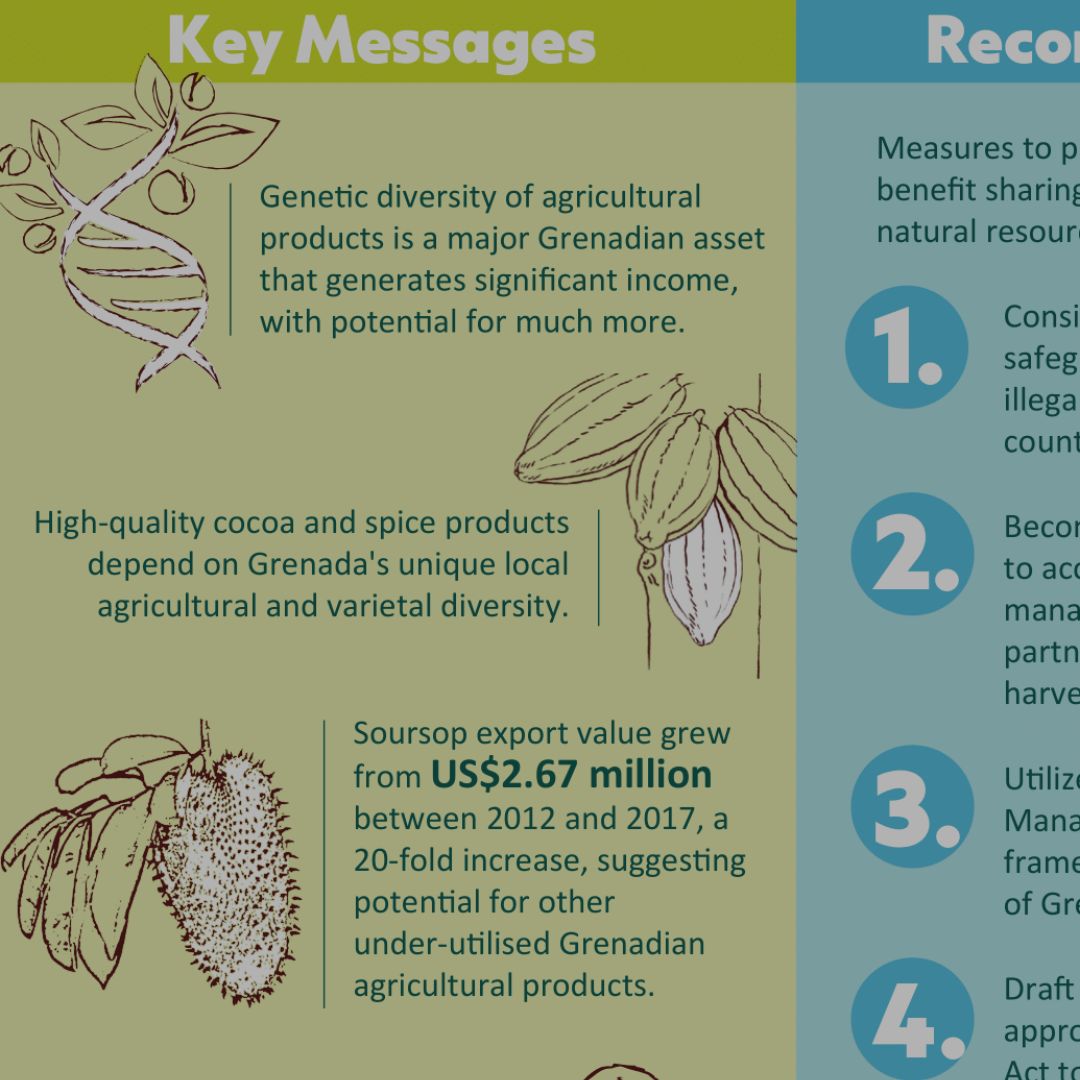

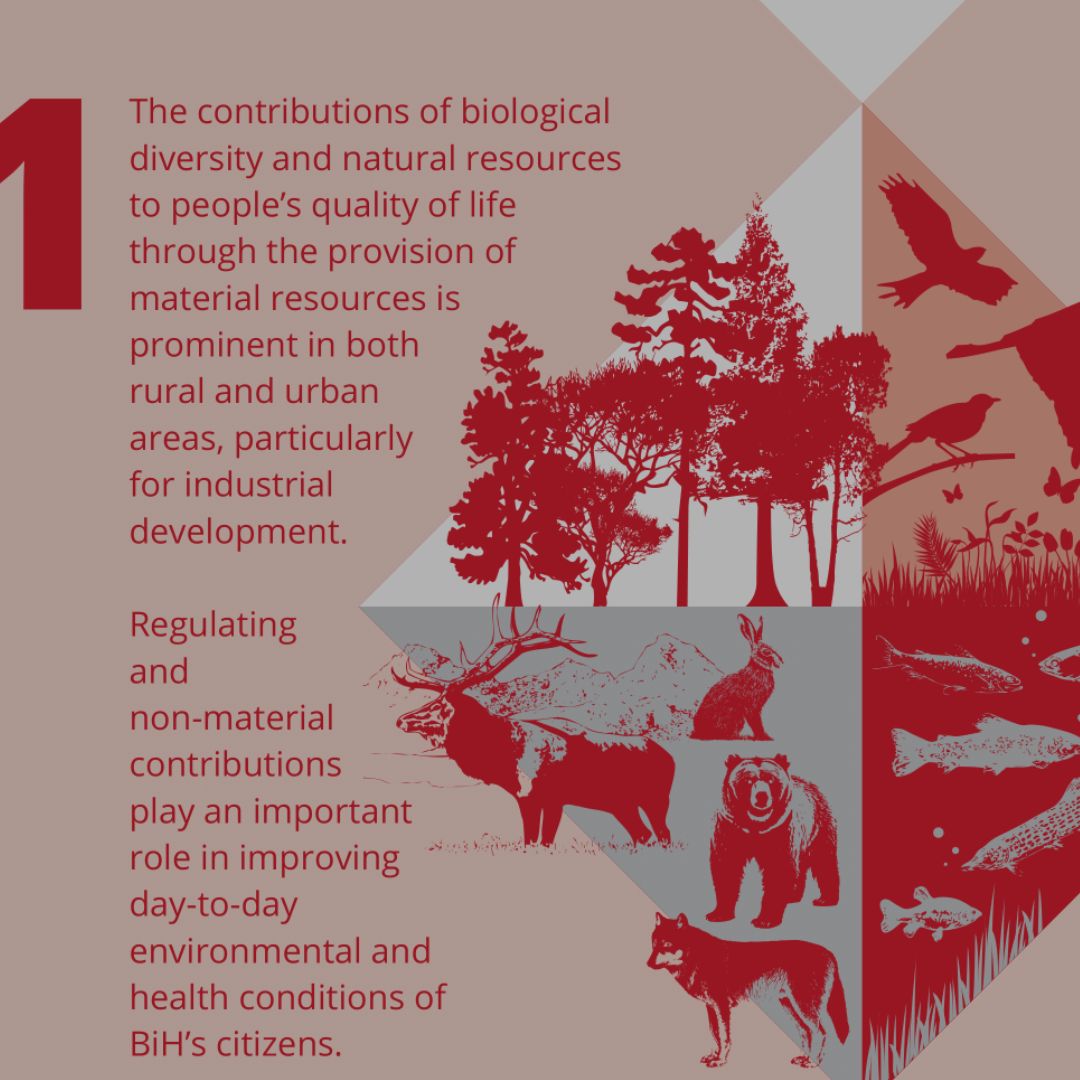

Natural capital is a way of thinking about nature as a stock that provides a flow of benefits to people and the economy. It consists of natural capital assets, such as water, forests, and clean air that provide humans with the means for healthy lives and enable economic activity. The goods and services that natural capital provides, such as food, water, or climate regulation are called ecosystem services, and these underpin all economic activity. Any adverse changes in natural capital, therefore, have a potentially negative effect on the businesses that depend on it. Human interactions with nature are depleting natural capital at an accelerating rate. This affects nature’s capacity to continue providing the ecosystems services on which the economy depends. Environmental change can therefore trigger significant disruptions to economic production. Financial institutions are exposed to natural capital risks that affect the businesses that they lend to or invest in. If a bank is lending to a farm that is unable to sustain production or facing increased costs due to water shortages, or whose crop is failing regularly due to changing climate conditions, then the farmer may not be able to service loan payments temporarily or may go out of business in the long term. Financial institutions wishing to understand and assess their exposure to natural capital risks have faced a lack of comprehensive and systematic information on how businesses depend on the environment and the consequences when that relationship is disrupted by environmental change.

Exploring natural capital opportunities, risks and exposure: A practical guide for financial institutions

Year: 2018