The Blended Finance Taskforce and KOIS Invest released a paper about blended finance for sustainable land-use (SLU), analysing how blended finance can mitigate risks and enhance returns for investors in this sector.

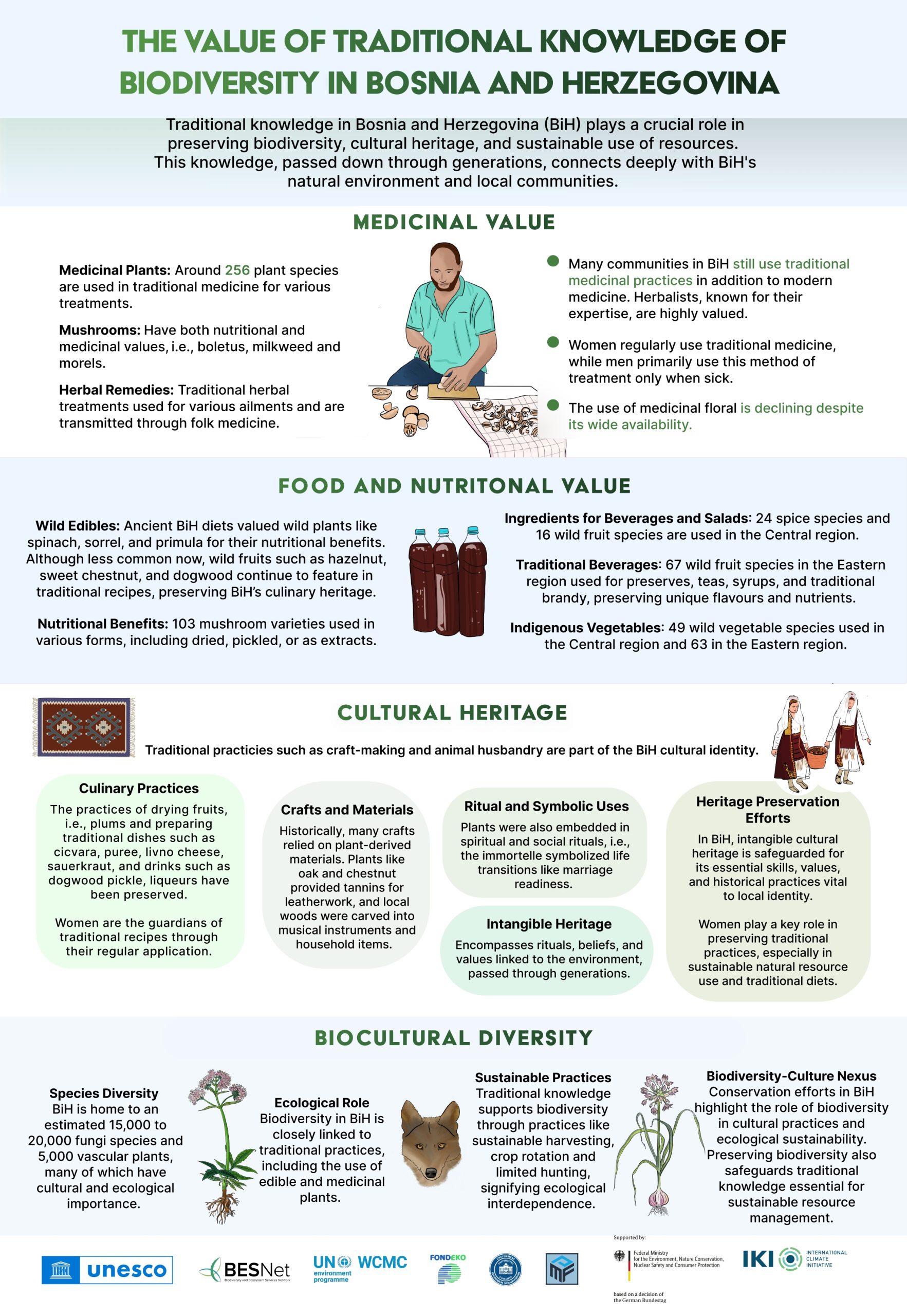

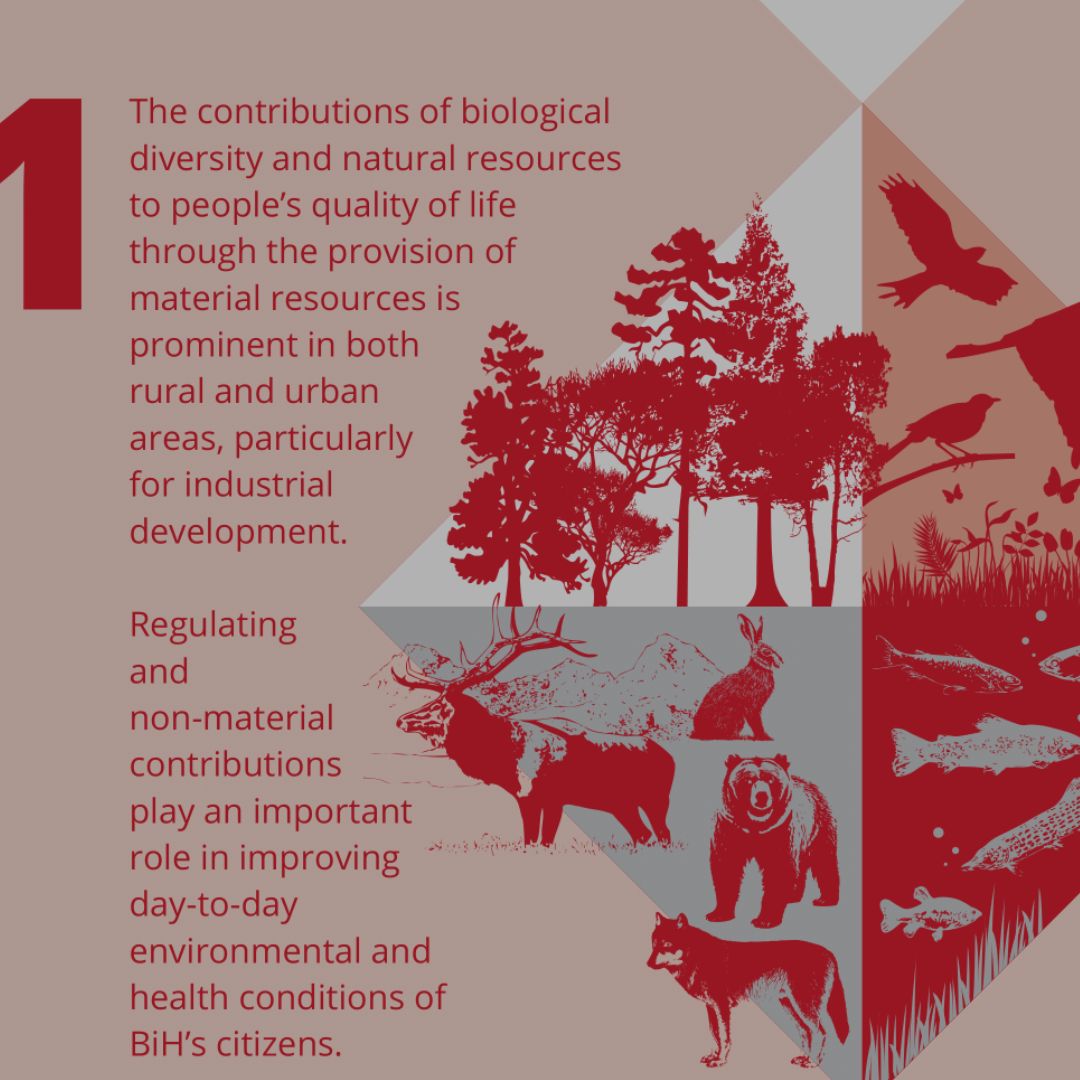

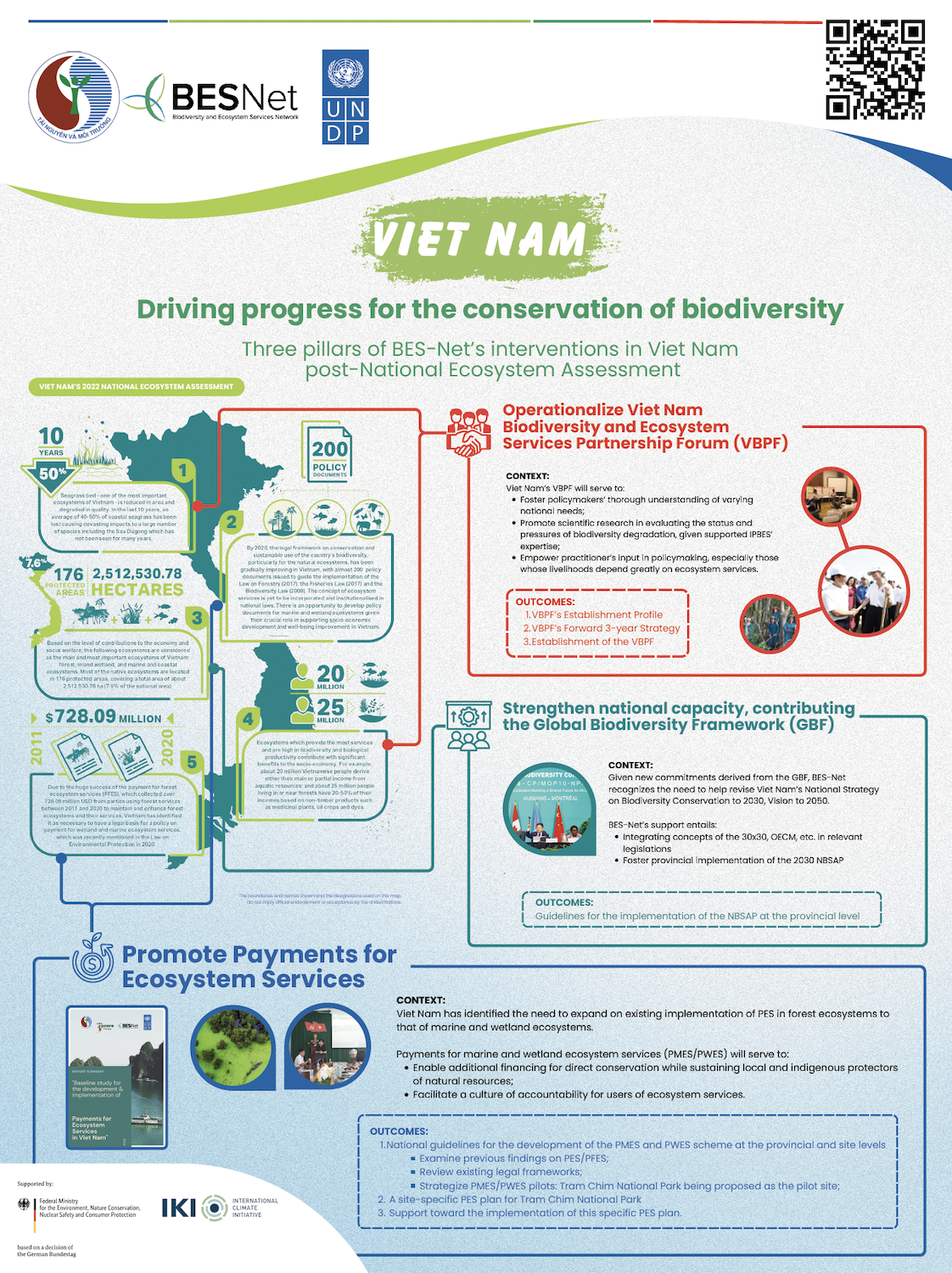

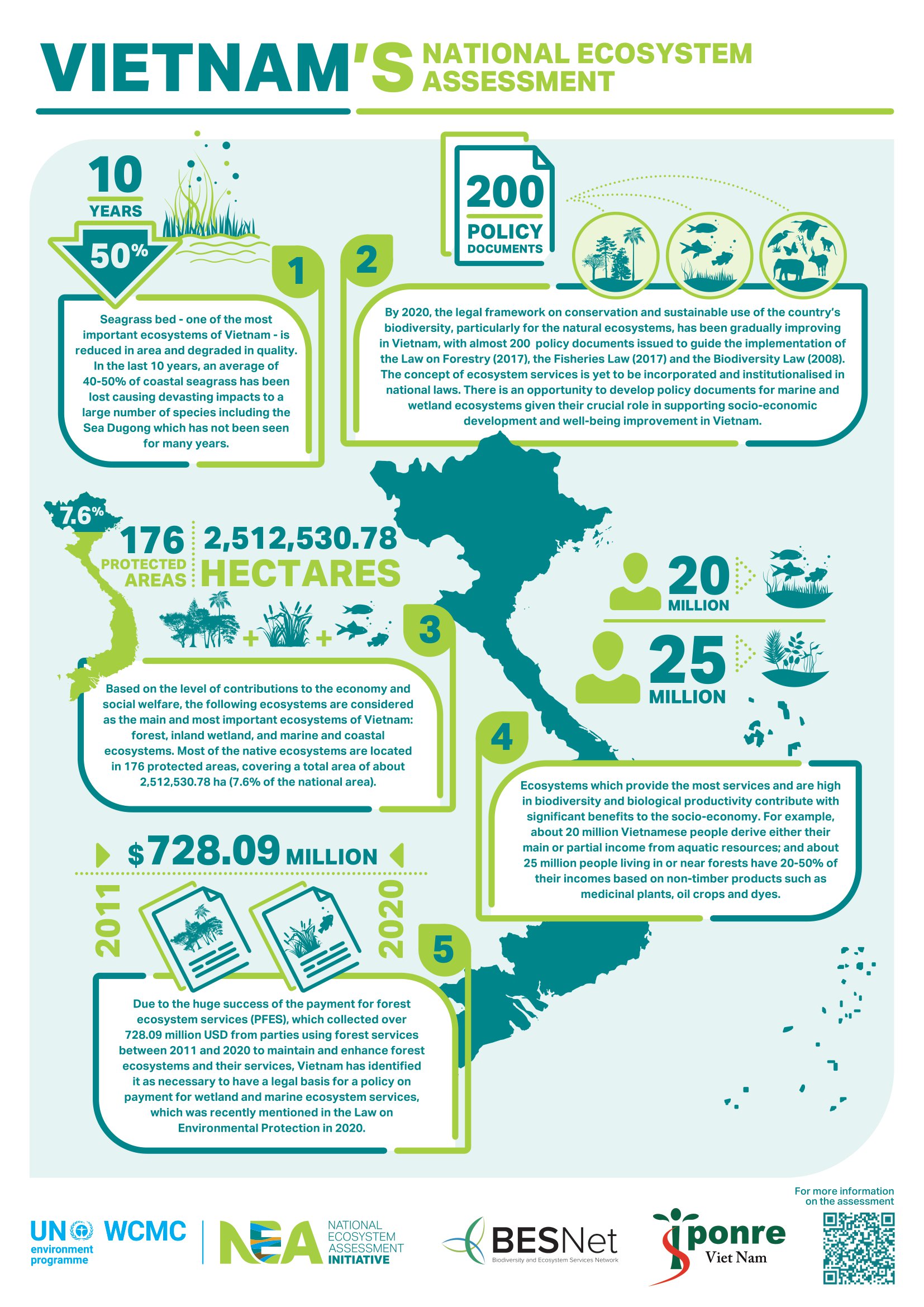

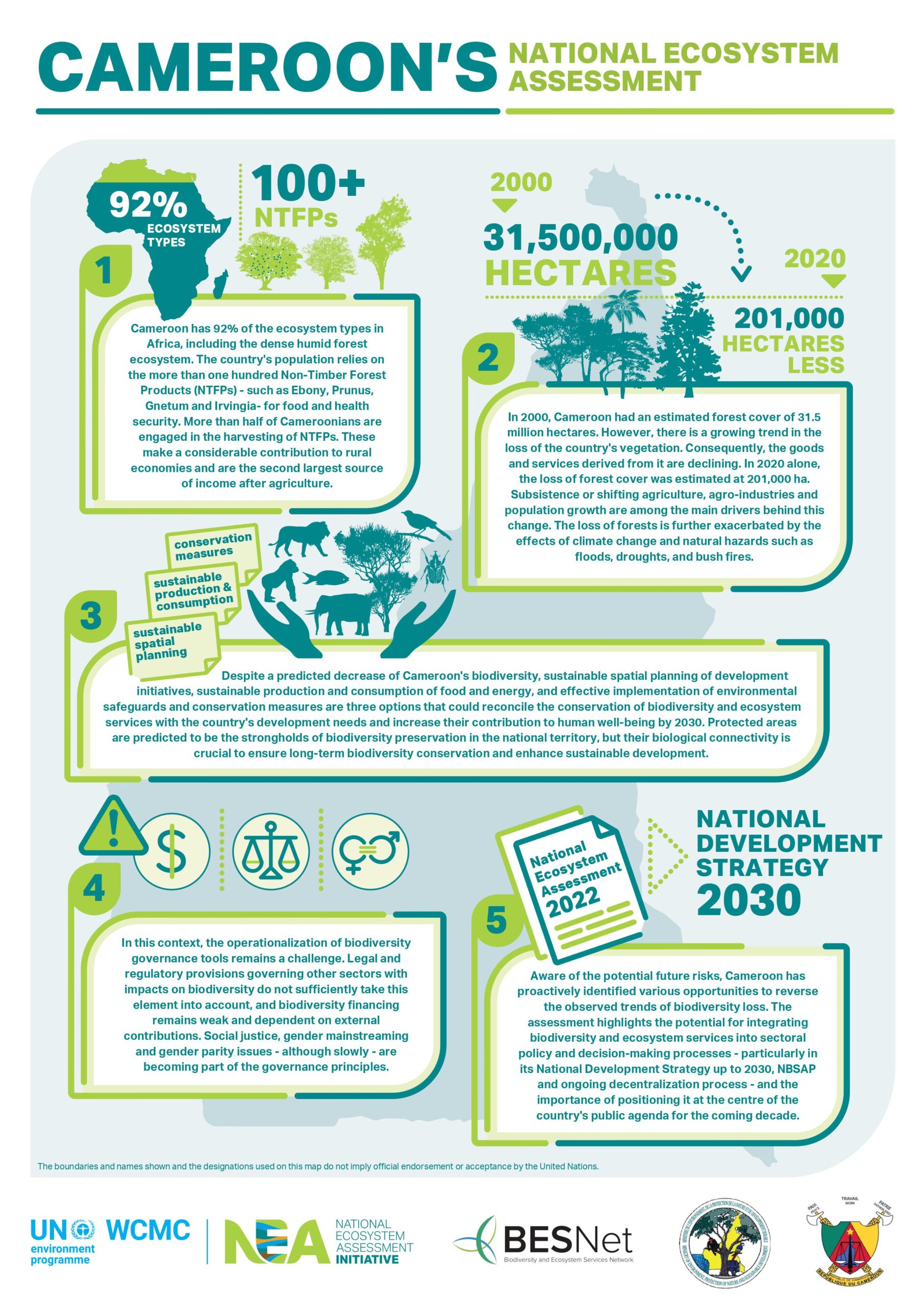

Growing demand for food and energy is putting increasing pressure globally on land and natural resources. SLU seeks to protect the climate by reducing carbon emissions and preserving carbon sinks by averting or mitigating deforestation, degradation and carbon-intensive agriculture while providing safeguards for meeting increasing needs for food and fibre as well as a habitat for biodiversity, with natural climate solutions being among the most impactful (particularly forest conservation, avoided deforestation, reforestation and forest landscape restoration).

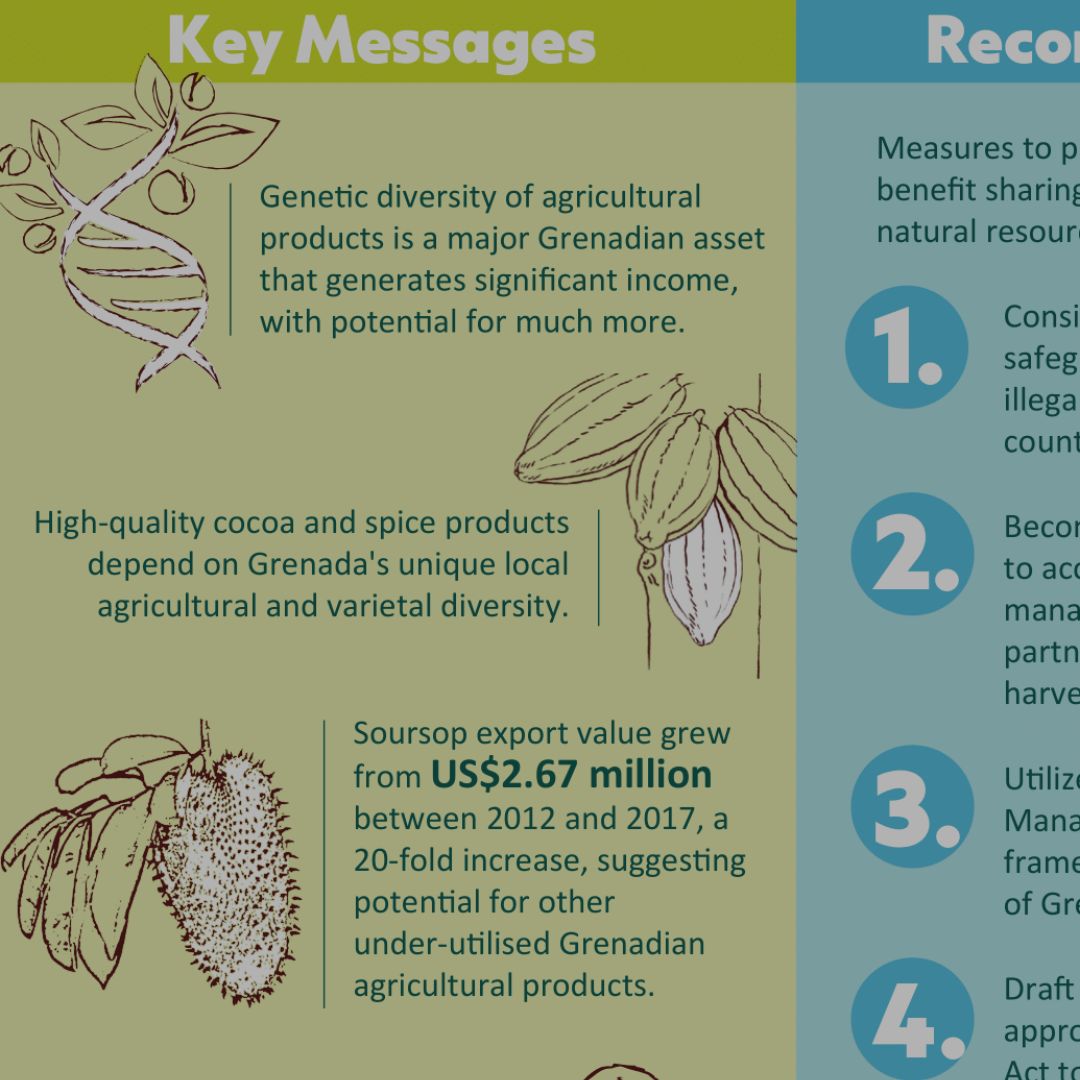

Private investment in SLU is not however at the scale needed to tackle the problem. According to KOIS, there needs to be a paradigm shift in the way in which (i) private sector investors view investment opportunities in SLU and how (ii) public and philanthropic investors engage to catalyse private capital in SDGs.

Many latent SLU investment opportunities with long-term growth potential in developing countries do exist, but financing SLU requires multi-sectoral coordination to integrate programs into a holistic landscape approach.